As we all know, 2020 was a year of huge upheaval, almost apocalyptic, and 2021 shows little sign of abatement. Factors outside our control changed the macro environment of our lives. As a result, we all had to adapt, change course and recalibrate our expectations. 2020 not only forced us to stay inside, it also changed how we seek and attain happiness.

Whilst the seven universal drivers of happiness remain unchanged, the way these drivers are manifested in our behaviour – our actions that are guided by the quest for happiness – has changed fundamentally. The events of 2020, and not least the global healthcare crisis, have forced a ‘happiness reset’.

Combining this macro-environmental analysis with qualitative insights from leading-edge consumers around the world, we identified 14 trends that define the post-2020 consumer. Quantification of the trends with over 15,000 consumers in 16 markets allows us to report trend scores (a measure of consumers’ attitudes towards the trends, as well as how they are acting upon the trend when buying brands) and a global trend mapping.

This analysis is highly relevant in understanding consumers’ search for happiness, affording brands opportunities to help them on this quest. In this article, we will explore the key trends for the Finance and Insurance sector, based on our 2021 Culture + Trends Report: Happiness Reset.

A higher purpose

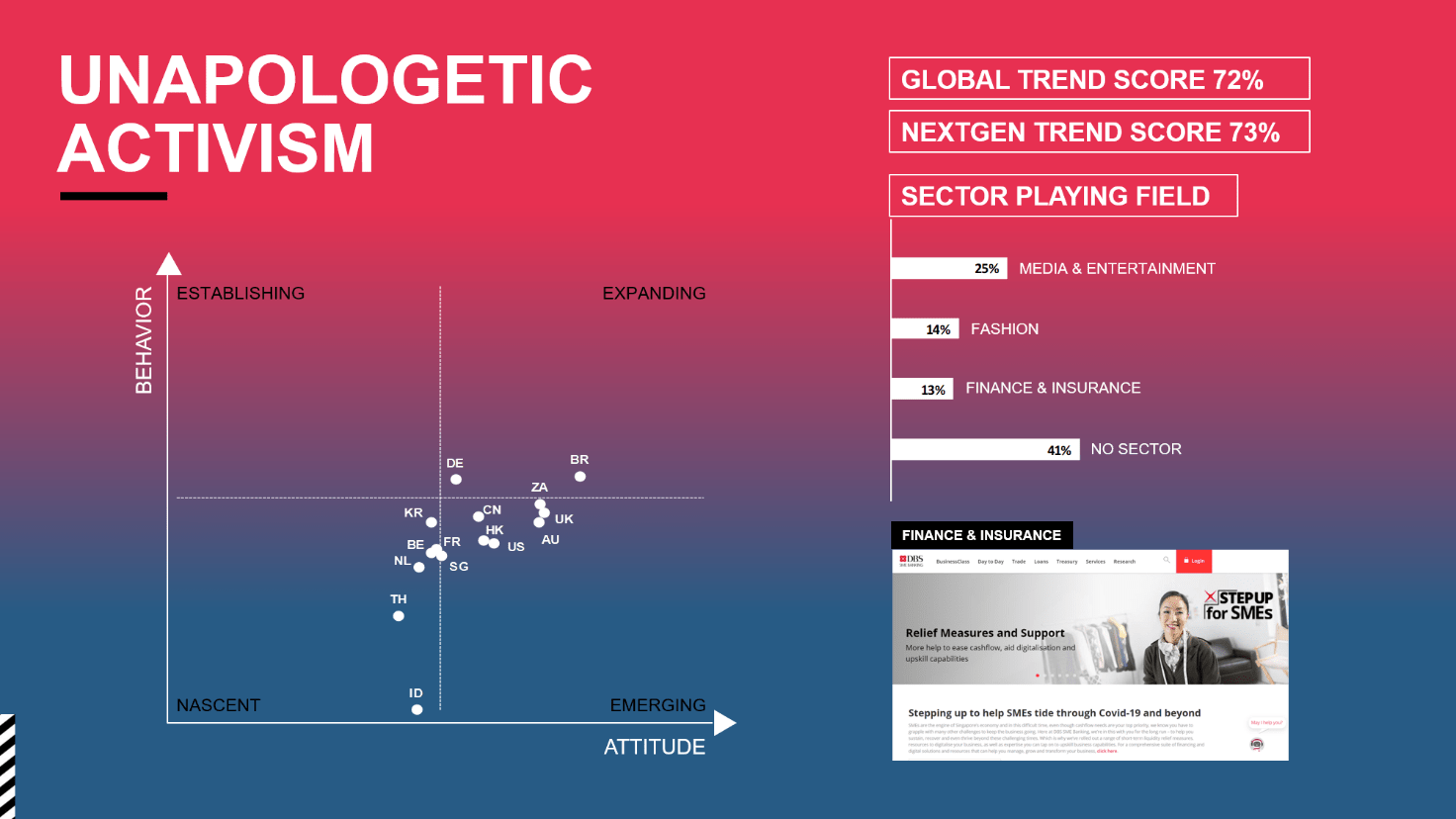

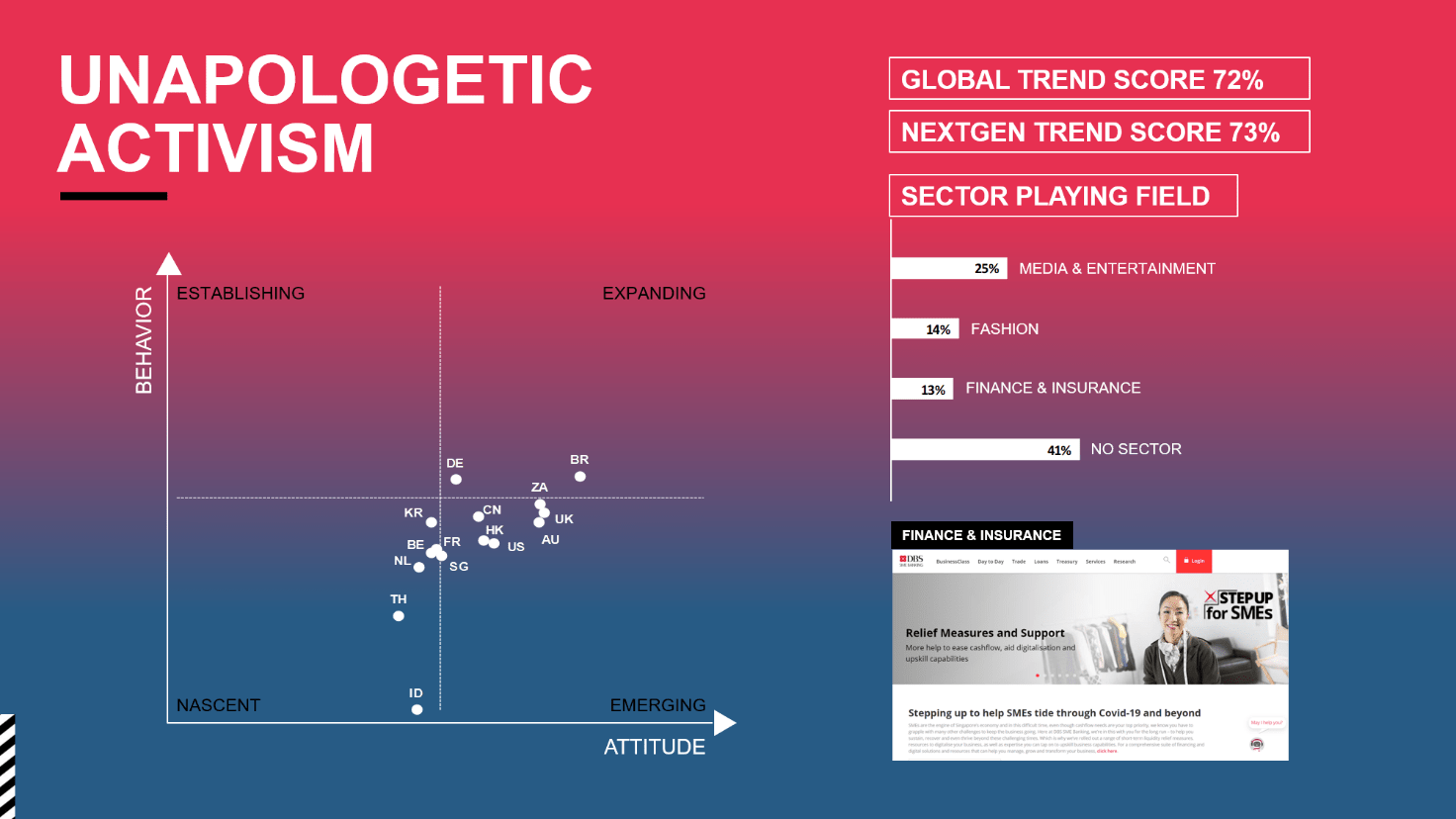

Post-2020, we see more people revisiting their sense of identity based on knowledge. They want to be re-educated to find Meaning. Rooted in this driver, we see a global trend for Unapologetic Activism.

In recent months, consumers around the world have been challenging societal ideas and systems. Many are looking for brands with an authentic voice to help them call out issues that are relevant to them. Moreover, young consumers are willing to spend more on brands that make a positive impact on society.

At present, Unapologetic Activism is an emerging trend in most markets, meaning that consumers have a positive attitude towards it; but few are acting upon it. This creates an opportunity for brands to convert opinion into action. 13% of consumers already see this trend as a good fit for the Finance & Insurance sector.

The post-2020 consumer strives for ‘purposeful wealth’, meaning that they are defined less by financial success and more by meaningful work. The Finance industry is broadening its offering and becoming more inclusive, and consumers will respond to this shift.

The shadow cast by the global pandemic has extended most to small and midsize enterprises (SMEs), highlighting the outsized role they play in the economies of South East Asia. Traditional banks especially are seen to have a responsibility to support these businesses during tough times. Since March 2020, DBS has approved about 9,500 collateral-free loans, totalling over $3 billion, to small and micro enterprises. DBS also donated SGD10.5 million to help communities hard hit by COVID-19.

New money interactions

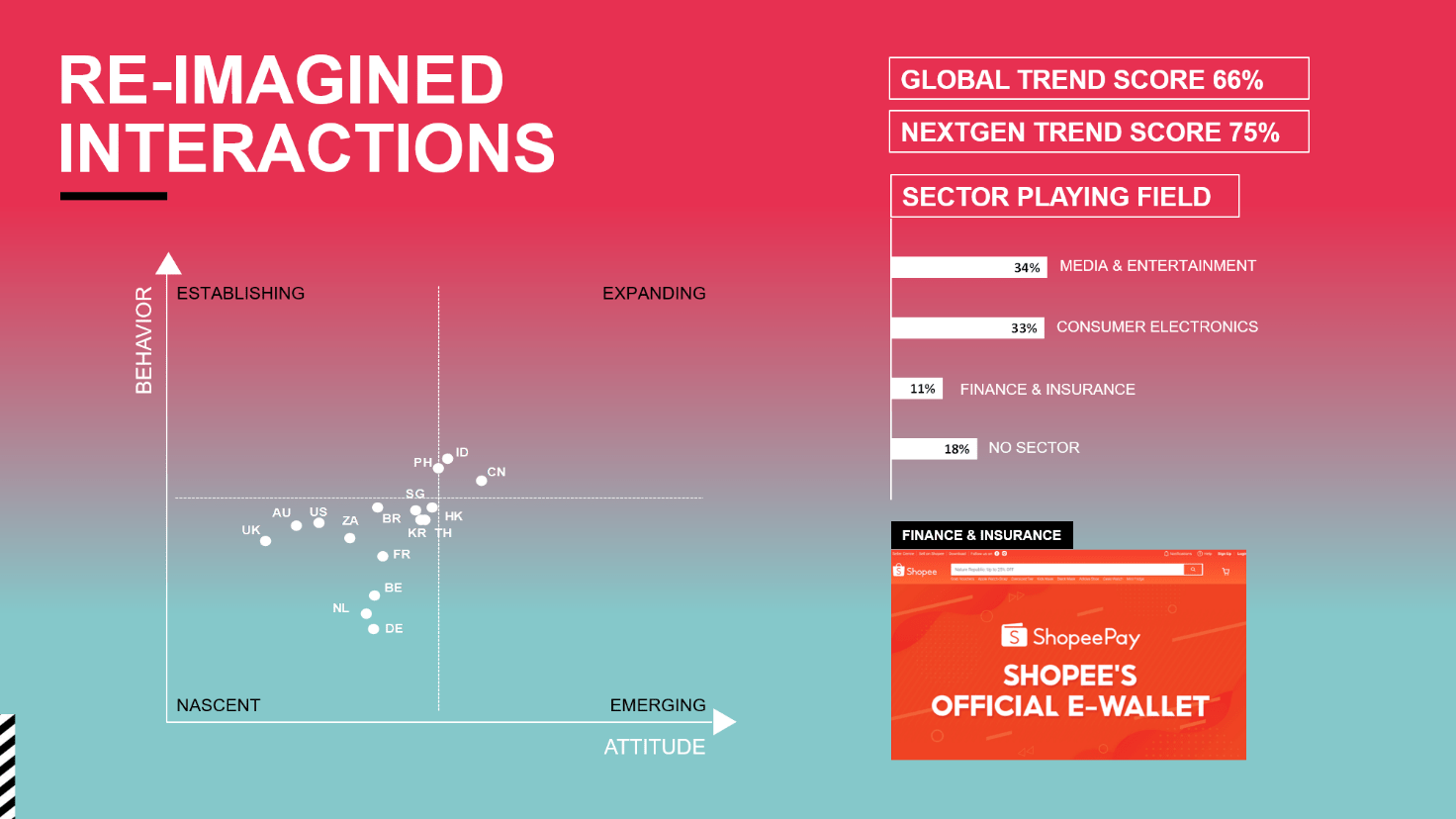

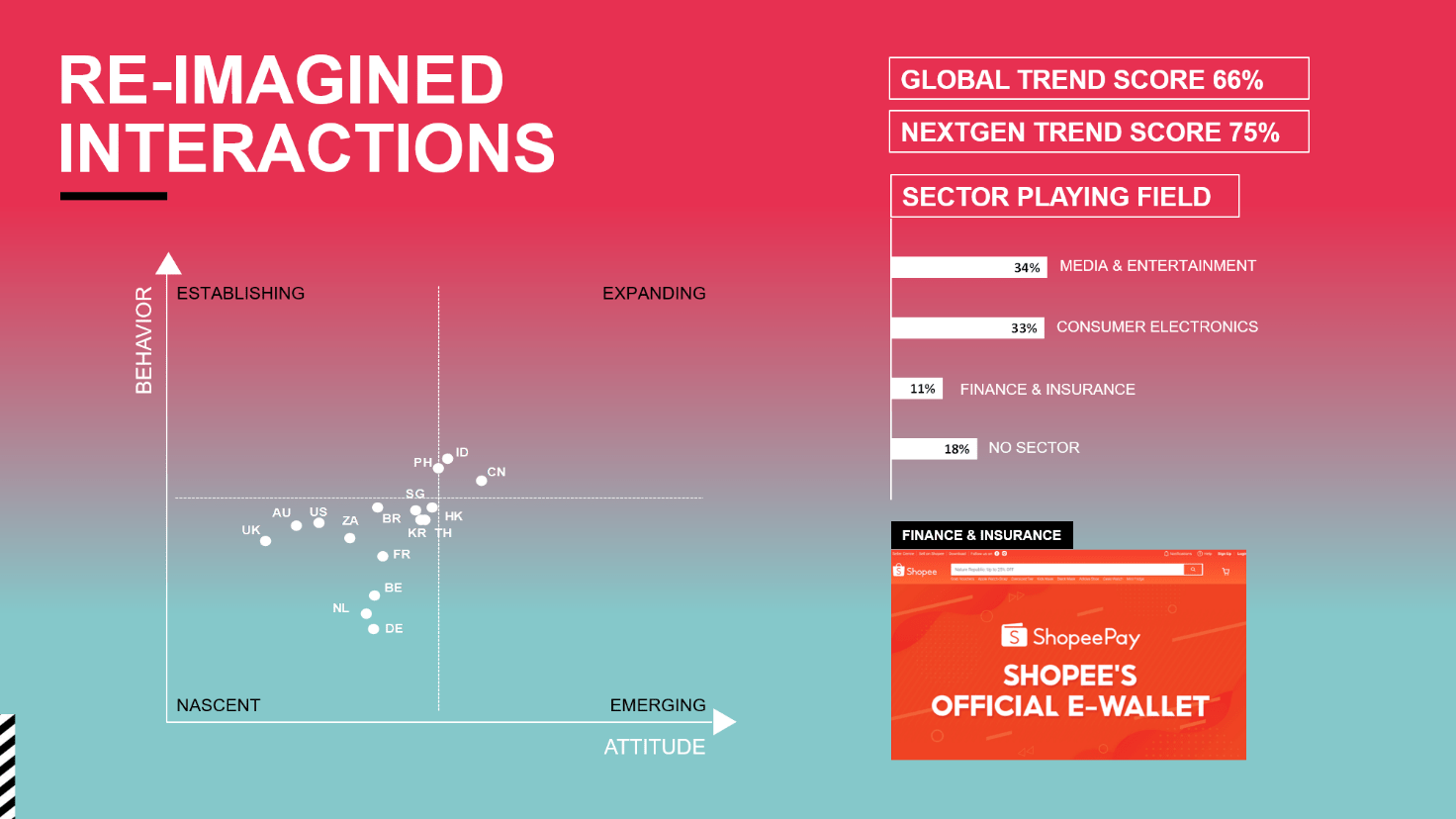

Post-2020, we will craft new Relationships and interactions amidst the growing belief that we do not have to do things the way we have always done before. In fact, we will crave brands that offer Re-imagined Interactions.

Pre-COVID-19, the Finance sector was facing digital transformation, but the shift from physical to online and mobile interactions has intensified during the pandemic, as digital adoption fast-forwarded five years. Digital technologies are being harnessed to put customers at the center of more personalized banking experiences.

Re-imagined Interactions, whilst being relatively nascent with the 40+ population, is already in an expanding stage with NextGen consumers. 11% of them feel the trend is a good fit for the Finance & Insurance sector to tap into. In Asia the trend is even stronger, as people have taken practical steps to maintain relationships through digital technologies.

In emerging markets of South East Asia, people are bypassing credit cards and going straight to local e-payments and e-wallets. The pandemic has accelerated the move to digital payments, even as governments are encouraging the march to cashless societies. From Indonesia’s GoPay to Singapore’s ShopeePay, e-wallets may be about to draw even more funds away from traditional banks.

As these new interactions with money become mainstream, brands must distinguish themselves to stay ahead, emphasising how they are uniquely positioned to become part of consumers’ lives, and offering tools and spaces designed to keep people connected to their money, and to each other.

Coaching for betterment

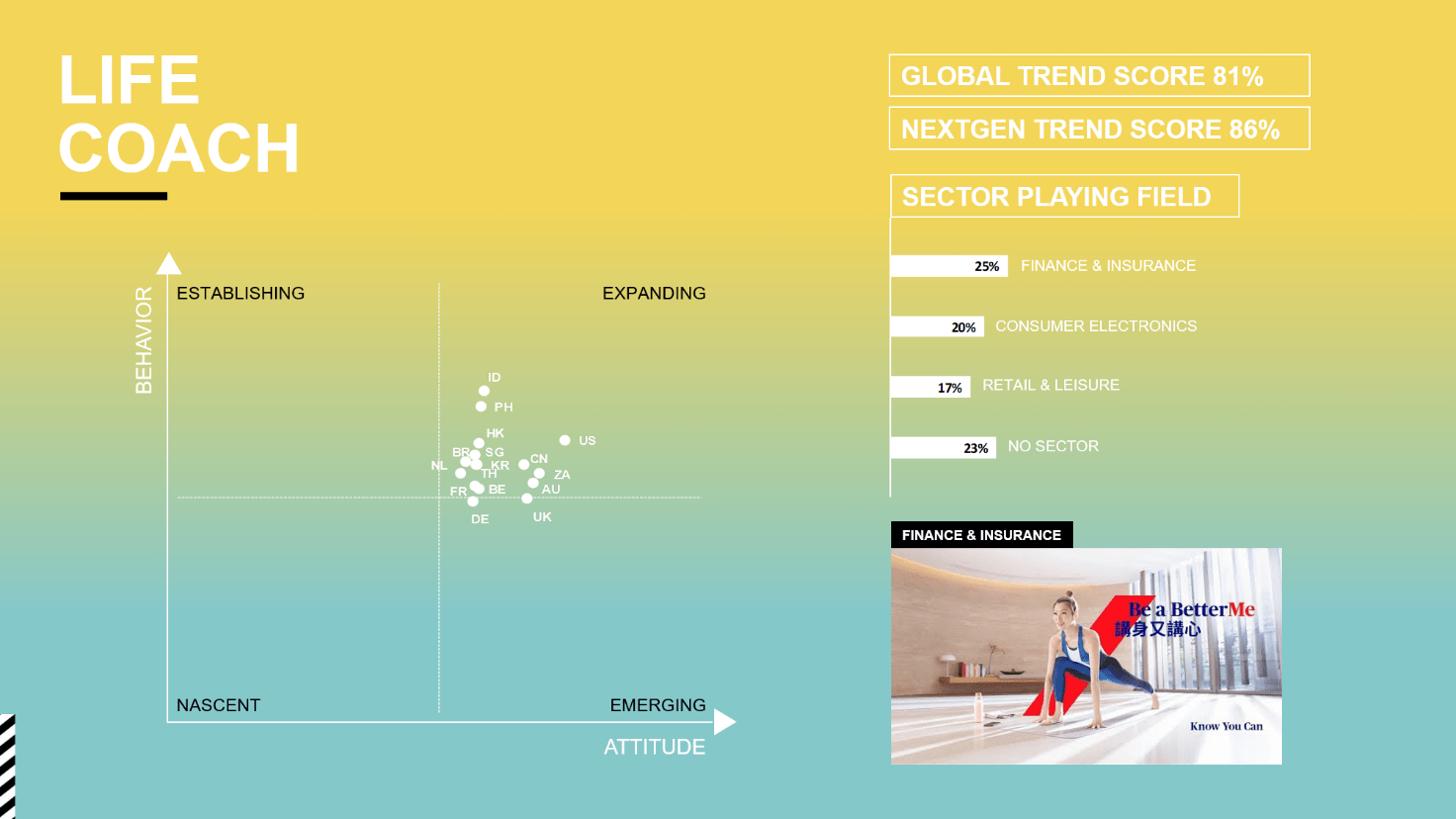

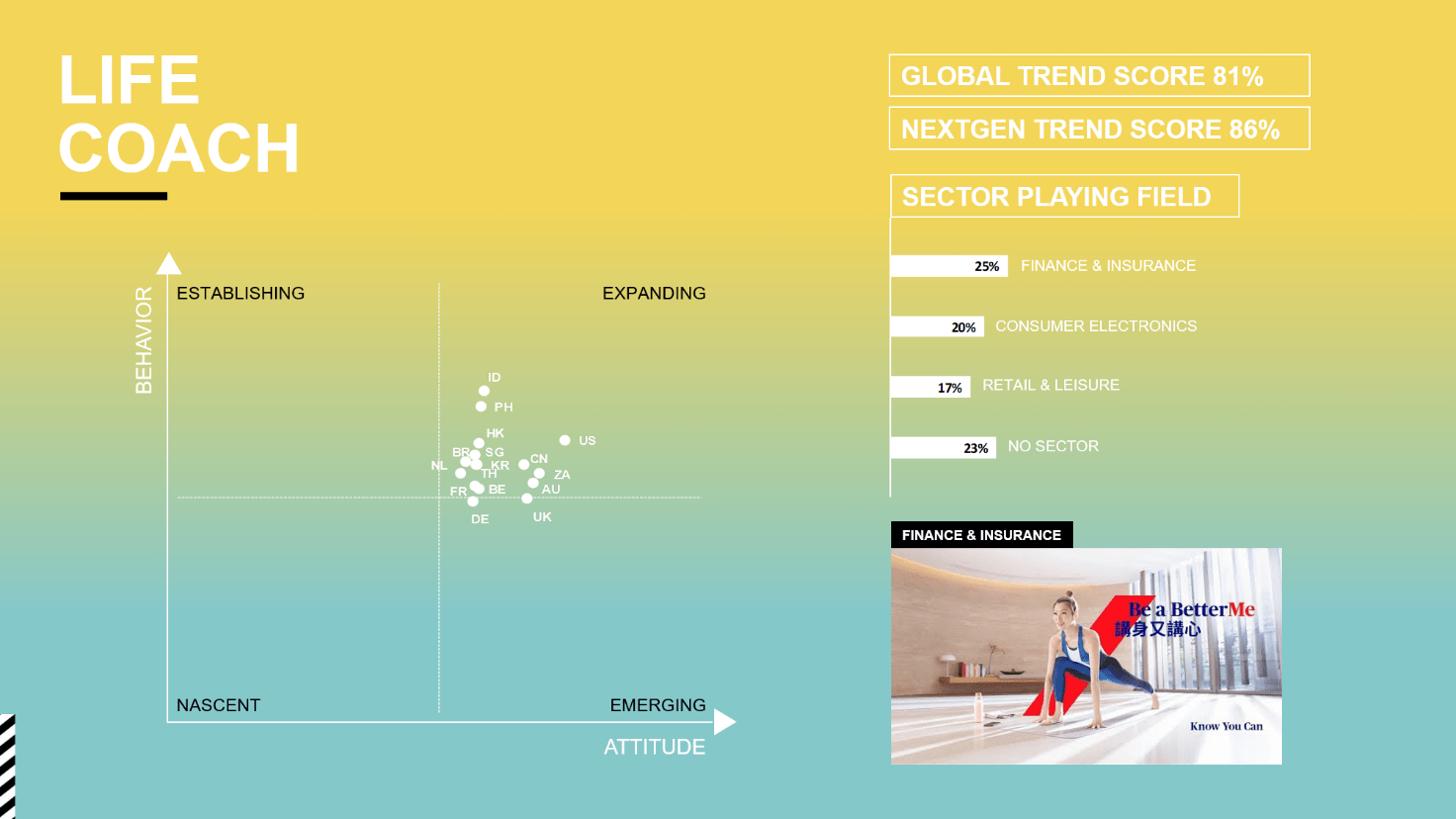

A trend that taps into the Achievement driver is Life Coach, the need for rituals and routines that provide a greater sense of control in our lives and in some cases achievement in these uncertain times.

Life Coach is an expanding trend in nearly all markets and is particularly relevant for Finance and Insurance brands, with 25% of consumers identifying this trend as suitable for the sector to tap into. NextGen consumers are highly attuned to this trend, making them a key target group for finance and fin-tech.

Well-being, fitness and meditation apps have grown in popularity during the pandemic, but finance apps are also weighing in, with insurers in Asia deepening their focus on coaching. AXA BetterMe offers close to 20 physical and mental health services, including Mind Charger, a mindfulness meditation tool with renowned yoga instructor Margaret Chung.

We can also expect banks to present a range of financial well-being solutions, specifically targeting NextGen consumers, many of whom recognize their need to harness technology in the face of uncertainty, with wiser saving and spending habits.

There are ample opportunities for brands to tap into the Life Coach trend, as consumers’ needs for help and support in controlling their finances is unlikely to wane. Brands that fit seamlessly into peoples’ lives will form part of their long-term routines.

Banking on an experience

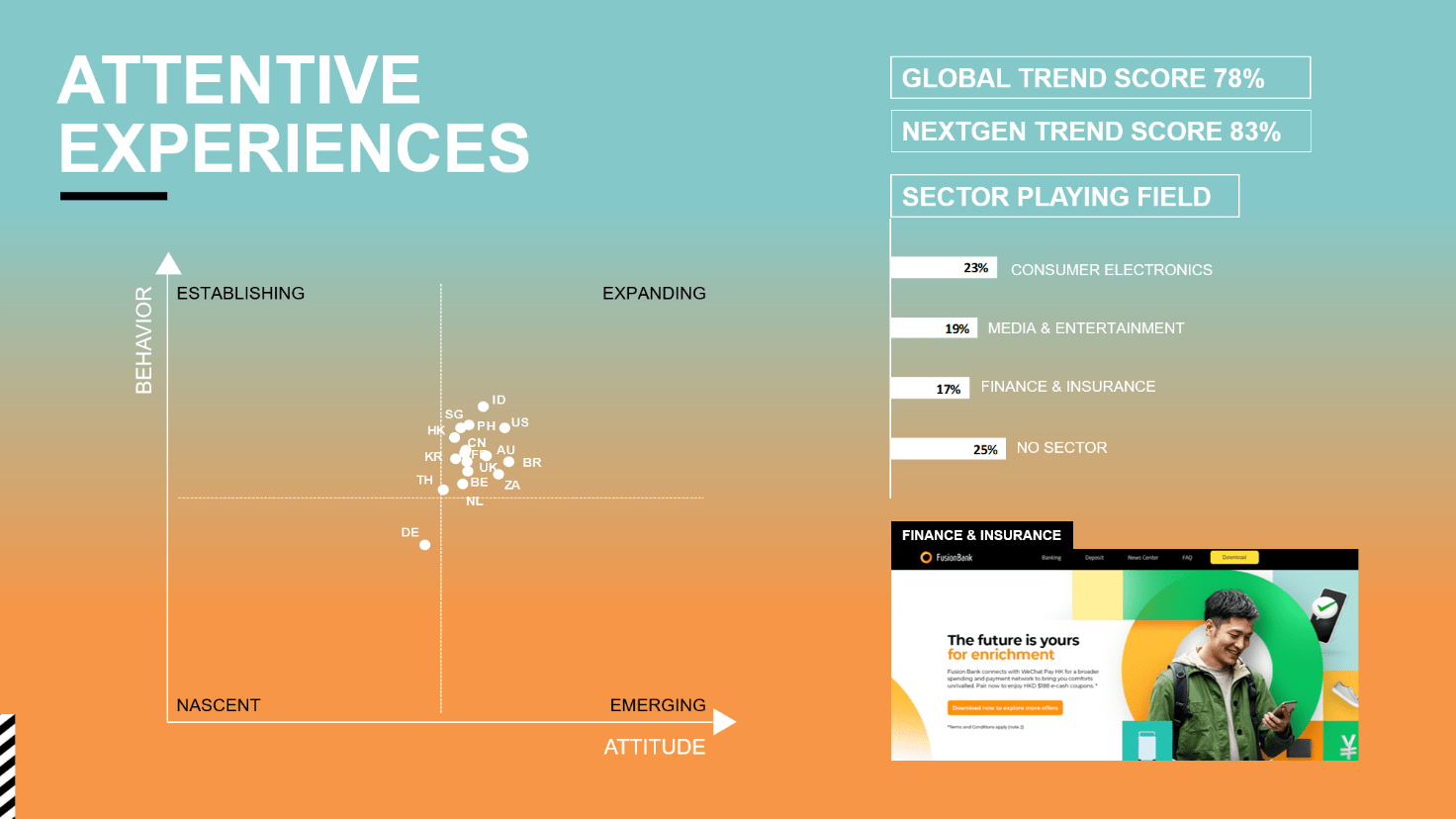

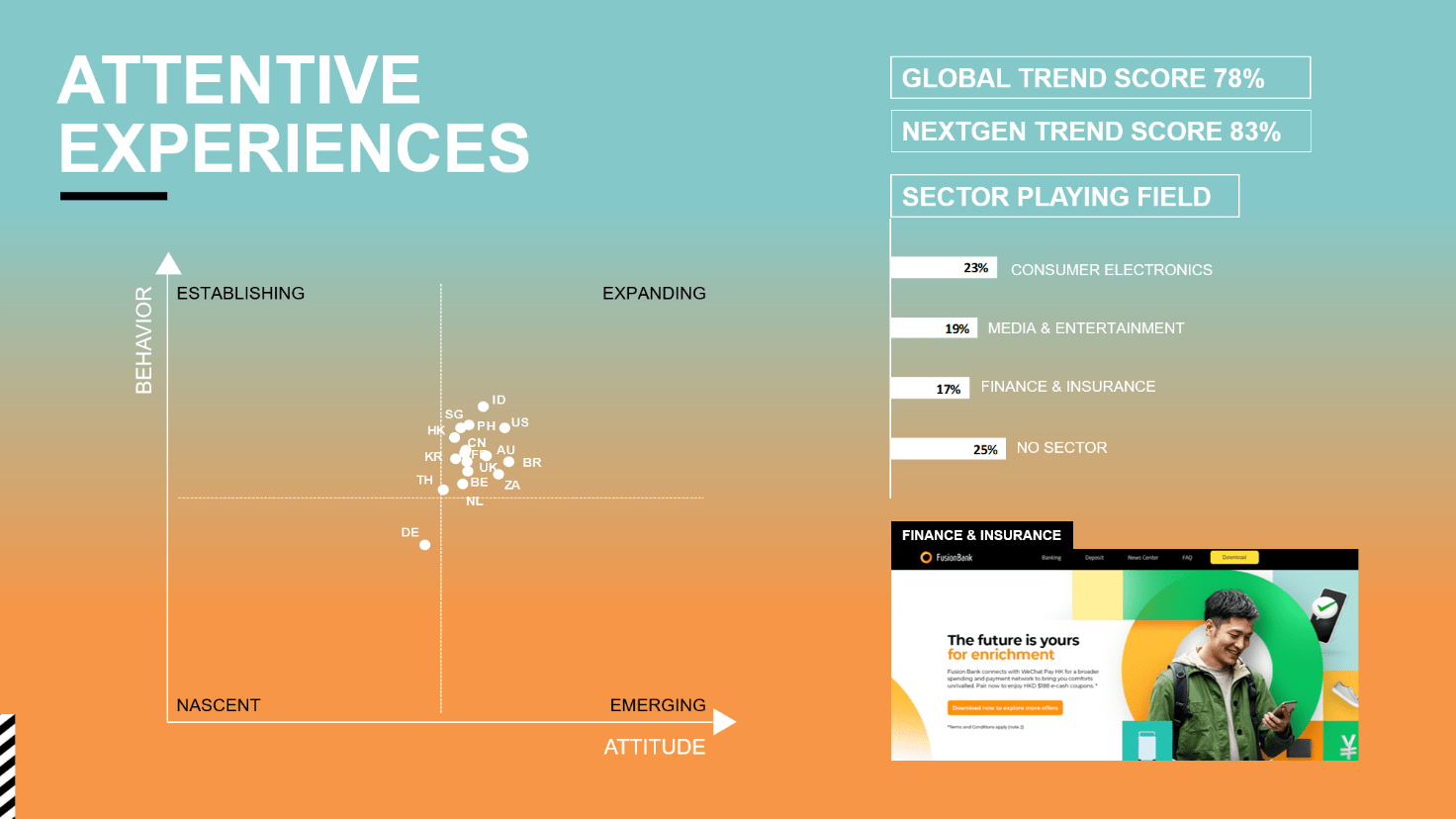

The Positive Emotions driver represents our need for pleasure, whilst Engagement is our need for focus. We see a strong trend which caters to both of these drivers, that of Attentive Experiences.

This is an expanding trend which is particularly strong for NextGen consumers. Consumers mostly see this trend represented in Consumer Electronics (23%) and only 17% in Finance & Insurance.

Both online and offline, brands can offer immersive experiences that connect with consumers in new ways, allowing for full engagement in the present moment. As money becomes more virtual (and less tangible), brands are finding ways to make it more experiential too. They are recognising that banking and insurance don’t need to be dull and can offer more than convenience in the digital era.

Virtual banks are ramping up their collaborations with merchants to offer more rewarding lifestyle experiences. For example, Fusion Bank is building a new ecosystem for customers to experience in future. Partnering with Tencent giant WeChat Pay HK, it helps customers maximize their spending capabilities with an extensive network of merchants in Hong Kong, and also connects them to mainland merchants covering fashion, food and beverage, living and travel.

Attentive Experiences is not all about digital. In premium banking, we also see traditional banks revamping the offline experiences they bring to their top tier customers.

Financial Resilience

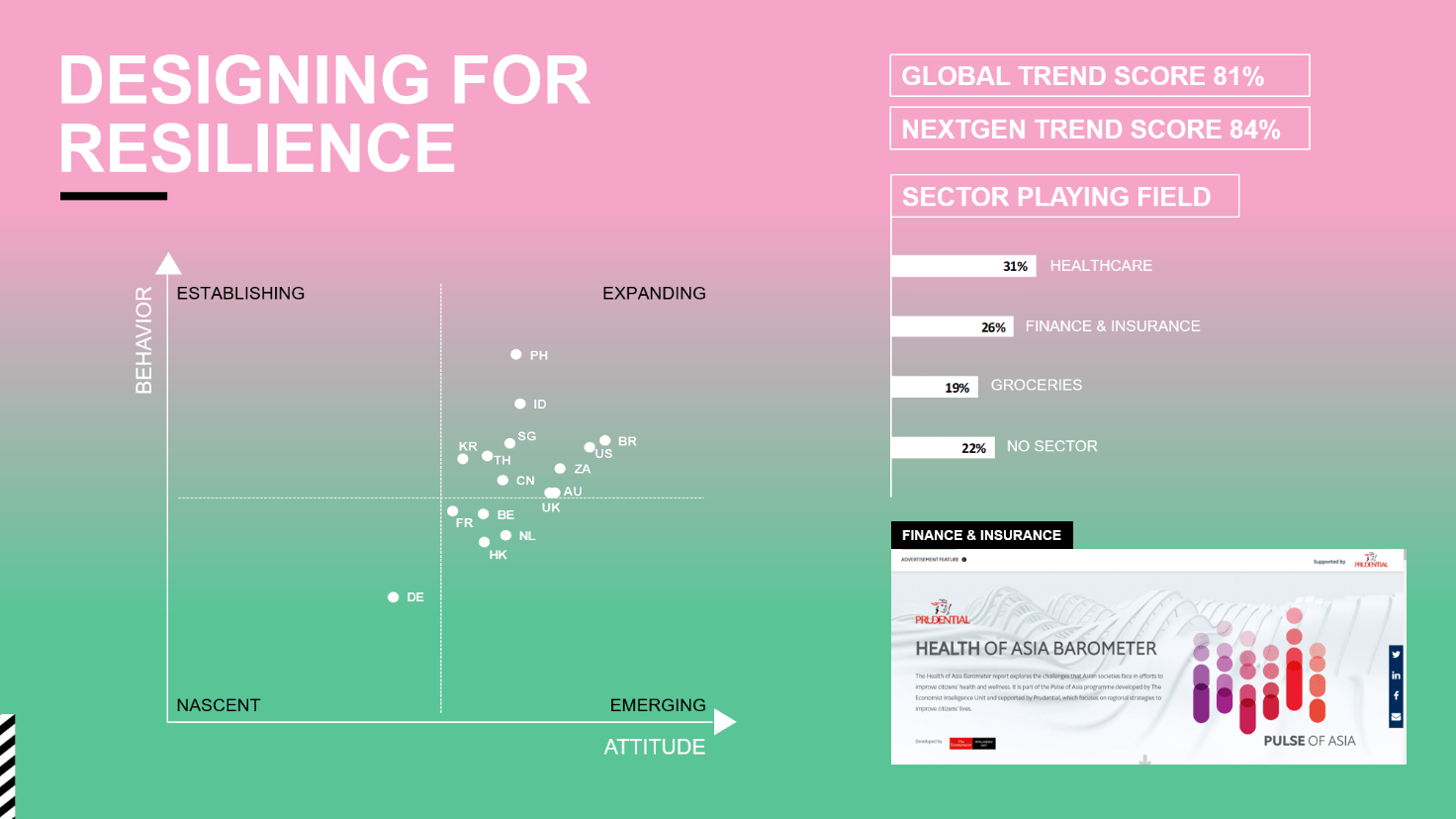

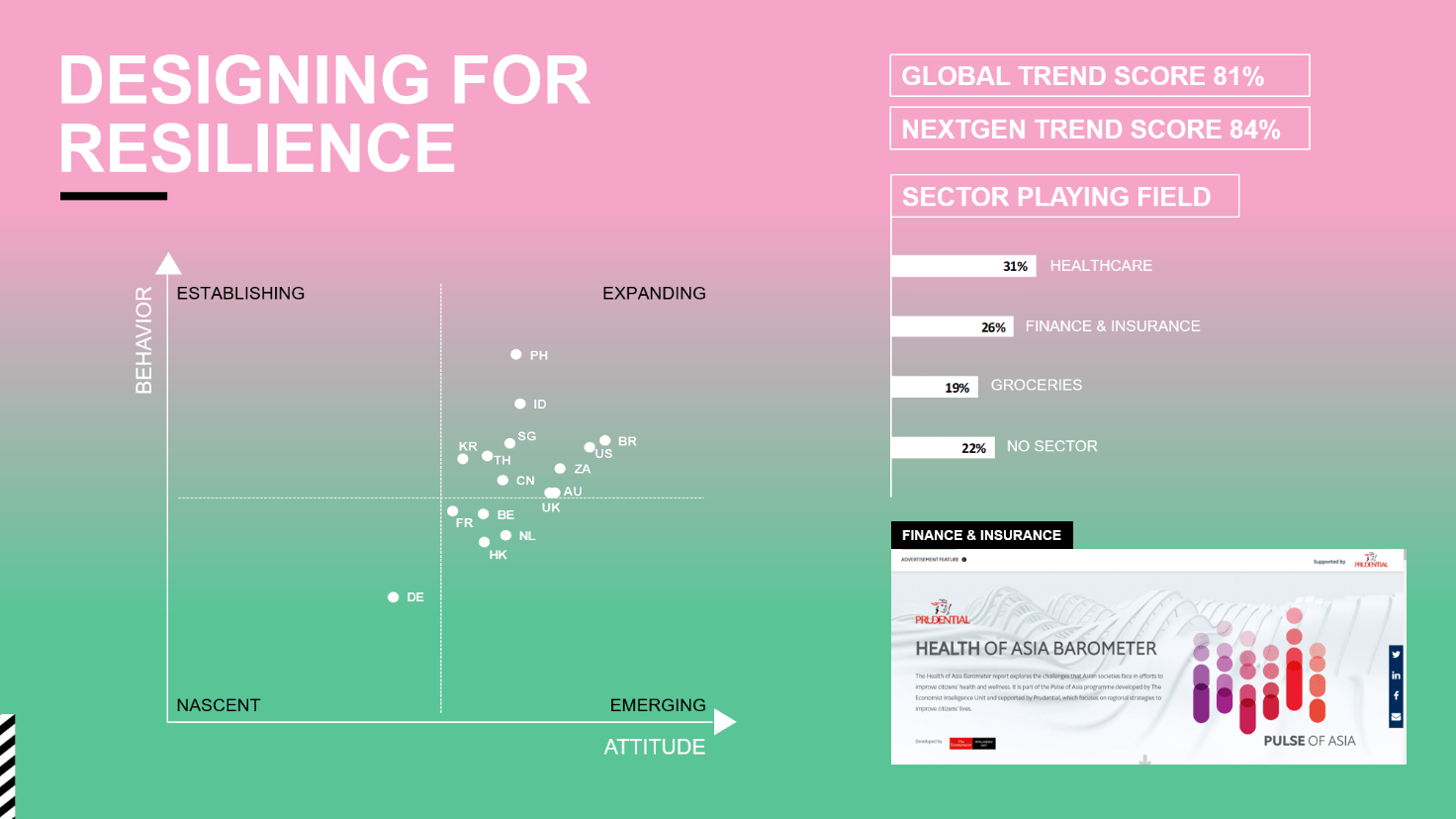

Manifesting from the Health and Security drivers, we see a trend coined Designing for Resilience: the need to make people feel protected from outside forces and help them build resilient mindsets.

Designing for Resilience was a growing trend pre-COVID-19 due to global fears around climate change and political instability, but it has been accelerated by the pandemic. It is now categorized as an expanding trend in most markets, scoring highly in both attitude and behaviour. It is also a strong trend for NextGen consumers, who are facing anxieties about their future around the world today.

From the consumers we surveyed, 26% identified Finance & Insurance as a relevant sector to play in this field. Spending and saving habits are shifting in the face of an uncertain financial future. With rising unemployment rates, a volatile stock market and a recession, consumers are tightening their belts. Moreover, the pandemic has made the link between financial stress and holistic ‘health and well-being’ even more apparent.

For example, Prudential’s ‘Health of Asia Barometer’ surveyed 5,000 people in Asia, to explore the challenges that Asian societies face in efforts to improve citizens’ health and well-being. They present a case that whilst much of the public is interested in improving their health, they often find it difficult to access or fund relevant products, services and information.

Financial players are making it easier for consumers to build up financial resilience, knowing that financial well-being impacts on overall health. What’s interesting is how much resilience in health and wealth may start to interact and overlap.

To summarize

- Conscious consumption has far-reaching implications for banks, insurers and investment providers, with many already turning to more impact-driven or purposeful finance initiatives around sustainability, diversity and inclusivity.

- Digital is fundamentally changing our relationship with money and how we interact with financial brands. The growth of e-payments and large tech players across the region signals a whole new world of interactions.

- Consumers today are looking for financial brands to proactively educate and coach them to be more in control of their finances, both through the use of technology and personal advice.

- Banking, insurance and investment are becoming more of an immersive experience, whether that is through new gamified digital experiences with new virtual banks or the latest garden wealth hubs in Singapore.

- The financial sector is playing a key role in helping to build our resilience to face future shocks and uncertainties, whether that is health, wealth or a combination of the two.

This is just the tip of the iceberg of how we can define the post-2020 consumer in Asia, with more data and insights available in our full report, which is available to download.